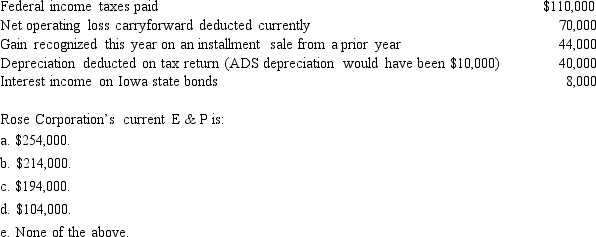

Rose Corporation (a calendar year taxpayer) has taxable income of $300,000, and its financial records reflect the following for the year.

Correct Answer:

Verified

Q51: Tern Corporation, a cash basis taxpayer, has

Q59: Cedar Corporation is a calendar year taxpayer

Q65: Falcon Corporation ended its first year of

Q67: During the current year, Hawk Corporation sold

Q70: Which of the following statements is incorrect

Q71: Blue Corporation has a deficit in accumulated

Q78: Glenda is the sole shareholder of Condor

Q79: Stacey and Andrew each own one-half of

Q86: Purple Corporation makes a property distribution to

Q146: On January 1,Gold Corporation (a calendar year

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents