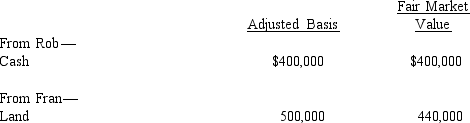

Rob and Fran form Bluebird Corporation with the following investments.  Each receives 50% of Bluebird's stock. In addition, Fran receives cash of $40,000. One result of these transfers is that Fran has a:

Each receives 50% of Bluebird's stock. In addition, Fran receives cash of $40,000. One result of these transfers is that Fran has a:

A) Recognized loss of $60,000.

B) Recognized loss of $20,000.

C) Basis of $460,000 in the Bluebird stock (assuming Bluebird reduces its basis in the land to $440,000) .

D) Basis of $400,000 in the Bluebird stock (assuming Bluebird reduces its basis in the land to $440,000) .

E) None of the above.

Correct Answer:

Verified

Q49: Ann transferred land worth $200,000, with a

Q50: Gabriella and Juanita form Luster Corporation. Gabriella

Q52: Jane transfers property (basis of $180,000 and

Q55: Kevin and Nicole form Indigo Corporation with

Q56: Amy owns 20% of the stock of

Q56: Ira, a calendar year taxpayer, purchases as

Q57: Rick transferred the following assets and liabilities

Q62: Erica transfers land worth $500,000, basis of

Q65: Rhonda and Marta form Blue Corporation. Rhonda

Q67: Wade and Paul form Swan Corporation with

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents