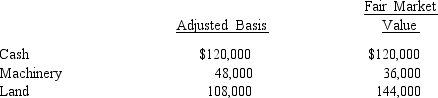

Hazel transferred the following assets to Starling Corporation.  In exchange, Hazel received 50% of Starling Corporation's only class of stock outstanding. The stock has no established value. However, all parties believe that the value of the stock Hazel received is the equivalent of the value of the assets she transferred. The only other shareholder, Rick, formed Starling Corporation five years ago.

In exchange, Hazel received 50% of Starling Corporation's only class of stock outstanding. The stock has no established value. However, all parties believe that the value of the stock Hazel received is the equivalent of the value of the assets she transferred. The only other shareholder, Rick, formed Starling Corporation five years ago.

A) Hazel has no gain or loss on the transfer.

B) Starling Corporation has a basis of $48,000 in the machinery and $108,000 in the land.

C) Starling Corporation has a basis of $36,000 in the machinery and $144,000 in the land.

D) Hazel has a basis of $276,000 in the stock of Starling Corporation.

E) None of the above.

Correct Answer:

Verified

Q23: If both §§ 357(b) and (c) apply

Q32: In return for legal services worth $60,000

Q34: To ease a liquidity problem, all of

Q38: A taxpayer transfers assets and liabilities to

Q42: If a shareholder owns stock received as

Q44: Rachel owns 100% of the stock of

Q53: Three individuals form Skylark Corporation with the

Q65: Rhonda and Marta form Blue Corporation. Rhonda

Q73: Sarah and Tony (mother and son) form

Q75: Albert transfers land (basis of $140,000 and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents