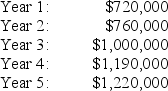

Nolan Company would like to open an office for five years in Southern California.The initial investment required to purchase an office building is $1,500,000,and Nolan needs $400,000 in working capital for the new office.Working capital will be released back to the company at the end of five years.The company expects to remodel the office at the end of 2 years at a cost of $180,000.The company only accepts projects that have a payback period of less than three years.Annual net cash receipts from daily operations (cash receipts minus cash payments)are expected to be as follows:

(1)Calculate the payback period for this project rounded to the nearest month.Show your work.

(2)Should the company accept this proposal? Explain.

Correct Answer:

Verified

Q61: Niwot Inc.is considering an investment that will

Q63: Davies Inc.would like to purchase a new

Q64: Idlewood Production Company would like to purchase

Q64: Before income taxes,McFadden Company had revenues of

Q66: Rambus Inc.would like to purchase a production

Q67: Lanyard Company is considering an investment that

Q69: Niwot Inc.is considering an investment that will

Q70: Lockwood Company would like to purchase a

Q70: The Law Offices of Nguyen and Kline

Q71: Rambus Inc.would like to purchase a production

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents