Davies Inc.would like to purchase a new machine for $300,000.The machine will have a life of four years with no salvage value,and is expected to generate annual cash revenue of $180,000.Annual cash expenses,excluding depreciation,will total $20,000.The company uses the straight-line depreciation method,has a tax rate of 30 percent,and requires a 12 percent rate of return.

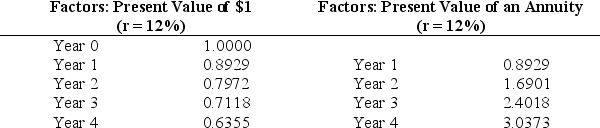

(1)Find the net present value of this investment using the following factors.

(2)Should the company purchase the machine? Explain.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q46: Exhibit 8-1

A project requires an initial

Q53: Solutions Inc.would like to purchase a new

Q58: Exhibit 8-1

A project requires an initial

Q61: Niwot Inc.is considering an investment that will

Q64: Idlewood Production Company would like to purchase

Q64: Before income taxes,McFadden Company had revenues of

Q66: Rambus Inc.would like to purchase a production

Q67: Lanyard Company is considering an investment that

Q67: Nolan Company would like to open an

Q70: Lockwood Company would like to purchase a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents