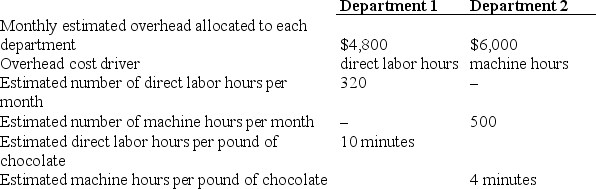

Specialty Chocolates recently expanded its operations beyond its existing kitchen to serve its retail operations by establishing a new kitchen to serve a wholesale market for local specialty shops.With this new arrangement,Specialty Chocolates will continue to have a retail shop attached to its original kitchen (Department 1) and the new wholesale operations shipping out of the new kitchen (Department 2) .Using normal costing,the company applies monthly overhead using predetermined overhead rates based on direct labor hours for the older operation in Department 1 and machine hours for overhead rates in the more automated Department 2.

Given this information,what are the respective overhead application rates to be used per pound of chocolate for Departments 1 and 2?

A) Department 1: $1.50 per pound;Department 2: $0.20 per pound.

B) Department 1: $0.25 per pound;Department 2: $0.20 per pound.

C) Department 1: $2.50 per pound;Department 2: $0.80 per pound.

D) Department 1: $0.25 per pound;Department 2: $2.00 per pound.

E) None of the answer choices is correct.

Correct Answer:

Verified

Q23: The law firm,Keen and Sholer,assigns overhead

Q24: The entry to record the requisition of

Q30: Kaplan Inc.applies overhead on the basis of

Q30: Silo Manufacturing received timesheets submitted by employees

Q31: The entry to record depreciation on the

Q32: Goodman Company has $30,000 in underapplied overhead,

Q35: The law firm,Keen and Sholer,assigns overhead

Q36: The Work in Process Inventory account for

Q38: If the Manufacturing Overhead account has a

Q39: Records at Sandy Inc.indicate that indirect materials

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents