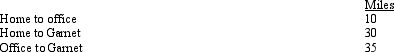

Amy works as an auditor for a large major CPA firm.During the months of September through November of each year, she is permanently assigned to the team auditing Garnet Corporation.As a result, every day she drives from her home to Garnet and returns home after work.Mileage is as follows:  For these three months, Amy's deductible mileage for each workday is:

For these three months, Amy's deductible mileage for each workday is:

A) 0.

B) 30.

C) 35.

D) 60.

E) None of the above.

Correct Answer:

Verified

Q83: During the year, Peggy went from Nashville

Q84: Aaron is a self-employed practical nurse who

Q85: In terms of meeting the distance test

Q86: Which, if any, of the following factors

Q87: Carolyn is single and has a college

Q89: As to meeting the time test for

Q90: Due to a merger, Allison transfers from

Q91: A worker may prefer to be classified

Q92: Under the actual cost method, which, if

Q93: When using the automatic mileage method, which,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents