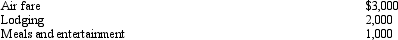

During the year, Oscar travels from Raleigh to Moscow (Russia) on business.His time was spent as follows: 2 days travel (one day each way) , 2 days business, and 2 days personal.His expenses for the trip were as follows (meals and lodging reflect only the business portion) :  Presuming no reimbursement, Oscar's deductible expenses are:

Presuming no reimbursement, Oscar's deductible expenses are:

A) $6,000.

B) $5,500.

C) $4,500.

D) $3,500.

E) None of the above.

Correct Answer:

Verified

Q94: Allowing for the cutback adjustment (50% reduction

Q95: During the year, Walt went from Louisville

Q96: Dave is the regional manager for a

Q97: Aiden is the city sales manager for

Q98: Statutory employees:

A) Report their expenses on Schedule

Q100: A worker may prefer to be treated

Q101: Donna, age 27 and unmarried, is an

Q102: Beth, age 51, has a traditional deductible

Q103: The § 222 deduction for tuition and

Q104: Kay, a single individual, participates in her

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents