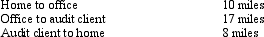

Bill is employed as an auditor by a CPA firm.On most days, he commutes by auto from his home to the office.During one month, however, he has an extensive audit assignment closer to home.For this engagement, Bill drives directly from home to the client's premises and back. Mileage information is summarized below:

If Bill spends 21 days on the audit, what is his deductible mileage?

If Bill spends 21 days on the audit, what is his deductible mileage?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q123: Gwen went to Paris on business.While there,

Q124: Arnold is employed as an assistant manager

Q125: After graduating from college, Clint obtained employment

Q126: Ava holds two jobs and attends graduate

Q127: During 2012, Eva used her car as

Q129: If a business retains someone to provide

Q130: Match the statements that relate to each

Q131: Match the statements that relate to each

Q132: In the current year, Bo accepted employment

Q133: Brian makes gifts as follows:

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents