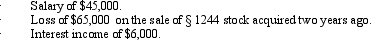

John files a return as a single taxpayer.In 2012, he had the following items:  Determine John's AGI for 2012.

Determine John's AGI for 2012.

A) ($5,000) .

B) $0.

C) $45,000.

D) $51,000.

E) None of the above.

Correct Answer:

Verified

Q41: Last year, Lucy purchased a $100,000 account

Q46: On June 2, 2011, Fred's TV Sales

Q48: Which of the following events would produce

Q49: A taxpayer may carry any NOL incurred

Q49: Three years ago, Sharon loaned her sister

Q51: On February 20, 2011, Bill purchased stock

Q52: Five years ago, Tom loaned his son

Q55: A farming NOL may be carried back

Q55: Bruce, who is single, had the following

Q56: Two years ago, Gina loaned Tom $50,000.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents