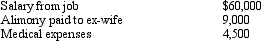

Larry, a calendar year cash basis taxpayer, has the following transactions:  Based on this information, Larry has:

Based on this information, Larry has:

A) AGI of $46,500.

B) AGI of $51,000.

C) AGI of $60,000.

D) Deduction for medical expenses of $0.

E) None of the above.

Correct Answer:

Verified

Q42: If a vacation home is a personal/rental

Q46: Marge sells land to her adult son,

Q46: If a vacation home is classified as

Q47: Ralph wants to give his daughter $1,000

Q49: Martha rents part of her personal residence

Q52: Hobby activity expenses are deductible from AGI

Q52: Which of the following can be claimed

Q53: Al single, age 60, and has gross

Q55: If a vacation home is rented for

Q55: Beulah's personal residence has an adjusted basis

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents