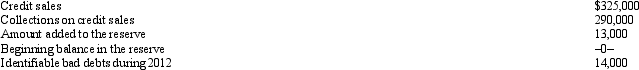

Petal, Inc.is an accrual basis taxpayer.Petal uses the aging approach to calculate the reserve for bad debts.During 2012, the following occur associated with bad debts.  The amount of the deduction for bad debt expense for Petal for 2012 is:

The amount of the deduction for bad debt expense for Petal for 2012 is:

A) $13,000.

B) $14,000.

C) $27,000.

D) $35,000.

E) None of the above.

Correct Answer:

Verified

Q64: Which of the following cannot be deducted

Q65: Andrew, who operates a laundry business, incurred

Q66: Which of the following are deductions for

Q68: Tom operates an illegal drug-running operation and

Q69: Payments by a cash basis taxpayer of

Q70: Rex, a cash basis calendar year taxpayer,

Q71: Which of the following is deductible as

Q72: Which of the following is a deduction

Q74: Benita incurred a business expense on December

Q77: Which of the following is not a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents