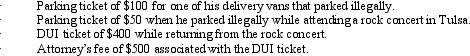

Andrew, who operates a laundry business, incurred the following expenses during the year.  What amount can Andrew deduct for these expenses?

What amount can Andrew deduct for these expenses?

A) $0.

B) $50.

C) $150.

D) $550.

E) None of the above.

Correct Answer:

Verified

Q47: If a vacation home is classified as

Q62: Which of the following is incorrect?

A) All

Q63: Terry and Jim are both involved in

Q64: Which of the following cannot be deducted

Q68: Tom operates an illegal drug-running operation and

Q69: Payments by a cash basis taxpayer of

Q69: Petal, Inc.is an accrual basis taxpayer.Petal uses

Q70: Rex, a cash basis calendar year taxpayer,

Q74: Tommy, an automobile mechanic employed by an

Q77: Which of the following is not a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents