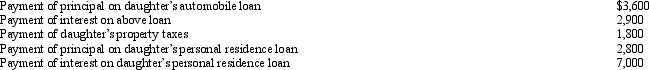

Melba incurred the following expenses for her dependent daughter during the current year:  How much may Melba deduct in computing her itemized deductions?

How much may Melba deduct in computing her itemized deductions?

A) $0.

B) $8,800.

C) $11,700.

D) $18,100.

E) None of the above.

Correct Answer:

Verified

Q81: If a vacation home is determined to

Q82: Which of the following is relevant in

Q83: In January, Lance sold stock with a

Q84: Bob and April own a house at

Q85: Austin, a single individual with a salary

Q88: Velma and Josh divorced. Velma's attorney fee

Q89: Which of the following statements is correct

Q91: Robyn rents her beach house for 60

Q96: If a residence is used primarily for

Q97: Which of the following is not deductible?

A)Moving

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents