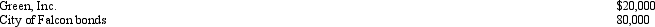

Brenda invested in the following stocks and bonds during 2012.

To finance the investments, she borrowed $100,000 from Swan Bank.Interest expense paid on the loan during 2012 was $6,000.During 2012, Brenda received $2,400 of dividend income from Green, Inc.and $3,200 of interest income on the municipal bonds.

To finance the investments, she borrowed $100,000 from Swan Bank.Interest expense paid on the loan during 2012 was $6,000.During 2012, Brenda received $2,400 of dividend income from Green, Inc.and $3,200 of interest income on the municipal bonds.

Correct Answer:

Verified

Q116: Trade or business expenses are classified as

Q123: If a taxpayer operated an illegal business

Q124: Are all personal expenses disallowed as deductions?

Q127: Graham, a CPA, has submitted a proposal

Q127: Salaries are considered an ordinary and necessary

Q132: Briefly discuss the two tests that an

Q136: Bobby operates a drug-trafficking business. Because he

Q139: Are there any circumstances under which lobbying

Q140: In applying the $1 million limit on

Q141: In a related-party transaction where realized loss

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents