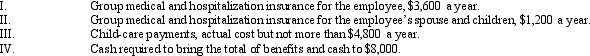

Under the Swan Company's cafeteria plan, all full-time employees are allowed to select any combination of the benefits below, but the total received by the employee cannot exceed $8,000 a year.  Which of the following statements is true?

Which of the following statements is true?

A) Sam, a full-time employee, selects choices II and III and $2,000 cash.His gross income must include the $2,000.

B) Paul, a full-time employee, elects to receive $8,000 cash because his wife's employer provided these same insurance benefits for him.Paul is not required to include the $8,000 in gross income.

C) Sue, a full-time employee, elects to receive choices I, II and $3,200 for III.Sue is required to include $3,200 in gross income.

D) All of the above.

E) None of the above.

Correct Answer:

Verified

Q66: Kristen's employer owns its building and provides

Q67: The Perfection Tax Service gives employees $12.50

Q68: Ridge is the manager of a motel.As

Q69: The Royal Motor Company manufactures automobiles.Employees of

Q70: Section 119 excludes the value of meals

Q72: The plant union is negotiating with the

Q73: A U.S.citizen worked in a foreign country

Q74: The employees of Mauve Accounting Services are

Q75: Heather is a full-time employee of the

Q76: Evaluate the following statements: ![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents