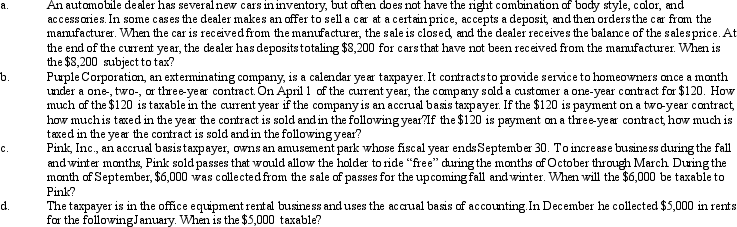

Determine the proper tax year for gross income inclusion in each of the following cases.

Correct Answer:

Verified

Q110: Sarah, a widow, is retired and receives

Q112: The amount of Social Security benefits received

Q112: Ted was shopping for a new automobile.

Q113: On January 1, 2012, Faye gave Todd,

Q114: In January 2012, Tammy purchased a bond

Q115: In some foreign countries, the tax law

Q117: Our tax laws encourage taxpayers to _

Q118: Debbie is age 67 and unmarried and

Q119: José, a cash method taxpayer, is a

Q120: Katherine is 60 years old and is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents