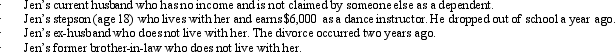

During 2012, Jen (age 66) furnished more than 50% of the support of the following persons:  Presuming all other dependency tests are met, on a separate return how many personal and dependency exemptions may Jen claim?

Presuming all other dependency tests are met, on a separate return how many personal and dependency exemptions may Jen claim?

A) Two.

B) Three.

C) Four.

D) Five.

E) None of the above.

Correct Answer:

Verified

Q91: Nelda is married to Chad, who abandoned

Q92: Wilma, age 70 and single, is claimed

Q93: The Hutters filed a joint return for

Q94: Kyle, whose wife died in December 2009,

Q95: Kyle and Liza are married and under

Q97: Millie, age 80, is supported during the

Q97: A qualifying child cannot include:

A)A nonresident alien.

B)A

Q98: Which of the following taxpayers may file

Q100: Arnold is married to Sybil, who abandoned

Q101: Heloise, age 74 and a widow, is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents