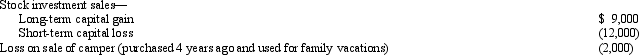

For the current year, David has salary income of $80,000 and the following property transactions:  What is David's AGI for the current year?

What is David's AGI for the current year?

A) $76,000.

B) $77,000.

C) $78,000.

D) $89,000.

E) None of the above.

Correct Answer:

Verified

Q115: Homer (age 68) and his wife Jean

Q116: Kirby is in the 15% tax bracket

Q117: During 2012, Addison has the following gains

Q118: Meg, age 23, is a full-time law

Q119: Taylor had the following transactions for 2012:

Q125: During 2012, Madison had salary income of

Q145: Adjusted gross income (AGI) sets the ceiling

Q146: Mel is not quite sure whether an

Q154: When married persons file a joint return,

Q158: Under what circumstances, if any, may an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents