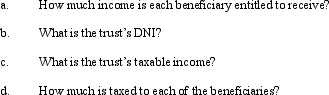

Counsell is a simple trust that correctly uses the calendar year for tax purposes.Its income beneficiaries (Kathie, Lynn, Mark, and Norelle) are entitled to the trust's annual accounting income in shares of one-fourth each.For the current calendar year, the trust has ordinary business income of $40,000, a long-term capital gain of $20,000 (allocable to income), and a trustee commission expense of $4,000 (allocable to corpus).Use the format of Figure 28.3 in the text to address the following items.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q124: Your client Ming is a complex trust

Q134: Counsell is a simple trust that correctly

Q135: List at least three non-tax reasons that

Q136: There are several business tax credits that

Q137: The trustee of the Miguel Trust can

Q137: Your client Pryce is one of the

Q140: The Circle Trust has some exempt interest

Q142: List the three major functions of distributable

Q147: Tax professionals use the terms simple trust

Q150: You are responsible for the Federal income

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents