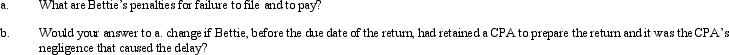

Bettie, a calendar year individual taxpayer, files her 2011 return on February 10, 2013.She had obtained a six-month extension for filing her return.There was additional income tax of $20,000 due with the return.

Correct Answer:

Verified

Q134: Compute the undervaluation penalty for each of

Q135: The IRS periodically updates its list of

Q138: When a tax dispute is resolved, interest

Q139: LaCharles made a charitable contribution of property

Q140: Troy Center Ltd.withheld from its employees' paychecks

Q142: Does the tax preparer enjoy an "attorney-client

Q144: Chung's AGI last year was $180,000. Her

Q156: A tax professional needs to know how

Q168: Describe the potential outcomes to a party

Q173: Circular 230 requires that the tax practitioner

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents