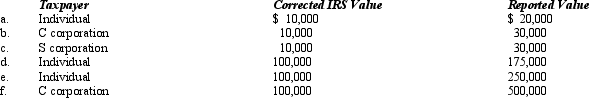

Compute the overvaluation penalty for each of the following independent cases involving the taxpayer's reporting of the fair market value of charitable contribution property.In each case, assume a marginal income tax rate of 35%.

Correct Answer:

Verified

Q120: For purposes of tax penalties, a VITA

Q121: Certain individuals are more likely than others

Q122: Describe the following written determinations that are

Q123: Yin-Li is the preparer of the Form

Q126: Leo underpaid his taxes by $250,000.Portions of

Q128: Clara underpaid her taxes by $50,000.Of this

Q149: Evaluate this statement: the audited taxpayer has

Q153: The Treasury issues "private letter rulings" and

Q164: In connection with the taxpayer penalty for

Q169: A taxpayer penalty may be waived if

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents