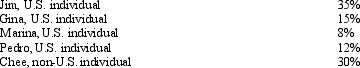

The following persons own Schlecht Corporation, a foreign corporation.  None of the shareholders are related.Subpart F income for the tax year is $300,000.No distributions are made.Which of the following statements is correct?

None of the shareholders are related.Subpart F income for the tax year is $300,000.No distributions are made.Which of the following statements is correct?

A) Schlecht is not a CFC.

B) Chee includes $90,000 in gross income.

C) Marina is not a U.S.shareholder.

D) Marina includes $24,000 in gross income.

E) None of the above statements is correct.

Correct Answer:

Verified

Q58: A tax haven often is:

A) A country

Q67: Kilps,a U.S.corporation,receives a $200,000 dividend from a

Q69: OutCo, a controlled foreign corporation owned 100%

Q73: A controlled foreign corporation (CFC) realizes Subpart

Q75: Copp, Inc., a domestic corporation, owns 30%

Q76: Amber, Inc., a domestic corporation receives a

Q77: BlueCo, a domestic corporation, incorporates its foreign

Q78: RedCo, a domestic corporation, incorporates its foreign

Q79: Ridge, Inc., a domestic corporation, reports worldwide

Q80: Which of the following income items does

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents