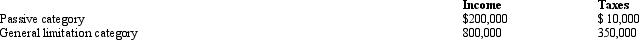

Britta, Inc., a U.S.corporation, reports foreign-source income and pays foreign taxes as follows.

Britta's worldwide taxable income is $1,600,000 and U.S.taxes before FTC are $560,000 (assume a 35% tax rate).What is Britta's U.S.tax liability after the FTC?

Britta's worldwide taxable income is $1,600,000 and U.S.taxes before FTC are $560,000 (assume a 35% tax rate).What is Britta's U.S.tax liability after the FTC?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q91: Which of the following foreign taxes paid

Q126: Discuss the primary purposes of income tax

Q132: Match the definition with the correct term.Not

Q133: Arendt, Inc., a domestic corporation, purchases a

Q134: USCo, a domestic corporation, receives $700,000 of

Q135: Match the definition with the correct term.

Q138: Which of the following statements regarding the

Q139: Given the following information, determine if FanCo,

Q140: USCo, a domestic corporation, reports worldwide taxable

Q141: BrazilCo, Inc., a foreign corporation with a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents