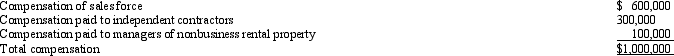

Given the following transactions for the year, determine Comp Corporation's D payroll factor denominator.State D has adopted the principles of UDITPA.

A) $1,000,000.

B) $900,000.

C) $700,000.

D) $600,000.

Correct Answer:

Verified

Q64: General Corporation is taxable in a number

Q65: Trayne Corporation's sales office and manufacturing plant

Q65: Britta Corporation's entire operations are located in

Q66: A use tax applies when a State

Q67: Judy, a regional sales manager, has her

Q68: Cruz Corporation owns manufacturing facilities in States

Q72: Bert Corporation, a calendar-year taxpayer, owns property

Q82: In the broadest application of the unitary

Q83: A taxpayer wishing to reduce the negative

Q87: A state sales tax usually falls upon:

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents