Determine Bowl's sales factors for States K, M, and N.

Bowl Corporation's manufacturing facility, distribution center, and retail store are located in State K.Bowl sells its products to residents located in States K, M, and N.

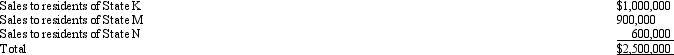

Sales to residents of K are conducted through a retail store.Sales to residents of M are obtained by Bowl's sales representative, who has the authority to accept and approve sales orders.Residents of N can purchase Bowl's product only if they place an order online and arrange to take delivery of the product at Bowl's shipping dock.Bowl's sales were as follows.

Bowl's activities within the three states are limited to those described above.All of the states have adopted a throwback provision and utilize a three-factor apportionment formula under which sales, property, and payroll are equally weighted.K sources dock sales to the destination state.

Bowl's activities within the three states are limited to those described above.All of the states have adopted a throwback provision and utilize a three-factor apportionment formula under which sales, property, and payroll are equally weighted.K sources dock sales to the destination state.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q102: Under the UDITPA's concept, sales are assumed

Q117: A _ tax is designed to complement

Q118: In computing the property factor, property owned

Q119: Node Corporation is subject to tax only

Q120: Typically, the state's payroll factor _ (does/does

Q122: You are completing the State A income

Q123: A number of court cases in the

Q124: Dott Corporation generated $300,000 of state taxable

Q125: Indicate for each transaction whether a sales

Q126: Pail Corporation is a merchandiser.It purchases overstock

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents