Mercy Corporation, headquartered in F, sells wireless computer devices, including keyboards and bar code readers. Mercy's degree of operations is sufficient to establish nexus only in E and

F.Determine its sales factor in those states.

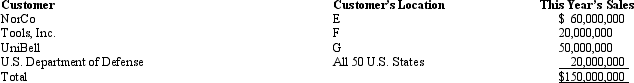

State E applies a throwback rule to sales, while State F does not.State G has not adopted an income tax to date.Mercy reported the following sales for the year.All of the goods were shipped from Mercy's F manufacturing facilities.

Because F has not adopted a throwback rule, the sales to customers in G and to the U.S.government are not included in either state's sales factor.Mercy creates $70 million in "nowhere sales."

E Sales factor = $60 million/$150 million = 40.00%

F Sales factor = $20 million/$150 million = 13.33%

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q134: Shaker Corporation operates in two states, as

Q137: Compost Corporation has finished its computation of

Q138: Milt Corporation owns and operates two facilities

Q140: Kim Corporation, a calendar year taxpayer, has

Q141: Bobby and Sally work for the same

Q142: List which items are included in the

Q144: You are preparing to make a presentation

Q172: In international taxation, we discuss income sourcing

Q183: Identify some state/local income tax issues facing

Q191: Your supervisor has shifted your responsibilities from

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents