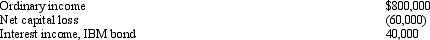

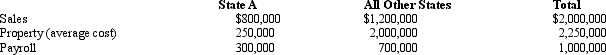

You are completing the State A income tax return for Quaint Company, LLC.Quaint operates in various states, showing the following results.

In A, all interest is treated as business income.A uses a sales-only apportionment factor.Compute Quaint's A taxable income.

In A, all interest is treated as business income.A uses a sales-only apportionment factor.Compute Quaint's A taxable income.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q117: A _ tax is designed to complement

Q118: In computing the property factor, property owned

Q119: Node Corporation is subject to tax only

Q120: Typically, the state's payroll factor _ (does/does

Q121: Determine Bowl's sales factors for States K,

Q123: A number of court cases in the

Q124: Dott Corporation generated $300,000 of state taxable

Q125: Indicate for each transaction whether a sales

Q126: Pail Corporation is a merchandiser.It purchases overstock

Q127: Hermann Corporation is based in State A

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents