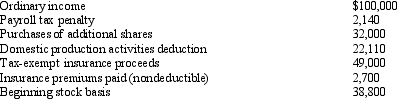

You are given the following facts about a one-shareholder S corporation. Prepare the shareholder's ending stock basis.

A) $168,660.

B) $192,850.

C) $214,960.

D) $263,960.

Correct Answer:

Verified

Q89: How large must total assets on Schedule

Q90: During 2012, Oxen Corporation incurs the following

Q91: During 2012, Dana Rippel, the sole shareholder

Q92: Which type of distribution from an S

Q93: On January 2, 2011, Tim loans his

Q95: A calendar year C corporation reports a

Q96: Ryan is the sole shareholder of Sweetwater

Q97: An S corporation reports a recognized built-in

Q98: Samantha owned 1,000 shares in Evita, Inc.,

Q99: Randall owns 800 shares in Fabrication, Inc.,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents