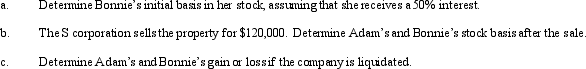

Individuals Adam and Bonnie form an S corporation, with Adam contributing cash of $100,000 for a 50% interest and Bonnie contributing appreciated ordinary income property with an adjusted basis of $20,000 and a fair market value of $100,000.

Correct Answer:

Verified

Q109: An S corporation recognizes a on any

Q119: Depreciation recapture income is a _ computed

Q137: The § 1202 exclusion of _ on

Q139: Meeting the definition of a small business

Q140: Tax-exempt income is listed on Schedule _

Q141: Towne, Inc., a calendar year S corporation,

Q143: You are a 60% owner of an

Q144: Estela, Inc., a calendar year S corporation,

Q145: Explain how the domestic production activities deduction

Q146: Blue Corporation elects S status effective for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents