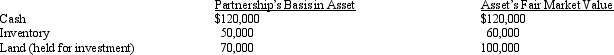

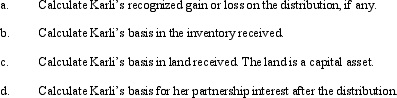

Karli owns a 25% capital and profits interest in the calendar-year KJDV Partnership.Her adjusted basis for her partnership interest on July 1 of the current year is $200,000.On that date, she receives a proportionate nonliquidating distribution of the following assets:

Correct Answer:

Verified

Q131: Cassandra is a 10% limited partner in

Q137: The BLM LLC's balance sheet on August

Q138: Landon received $50,000 cash and a capital

Q139: Match each of the following statements with

Q140: In a proportionate liquidating distribution, Scott receives

Q141: Harry and Sally are considering forming a

Q145: Hannah sells her 25% interest in the

Q146: In a proportionate liquidating distribution in which

Q147: The MOP Partnership is involved in leasing

Q170: Jeordie and Kendis created the JK Partnership

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents