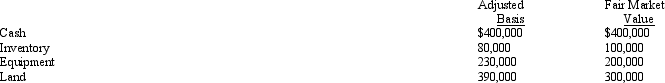

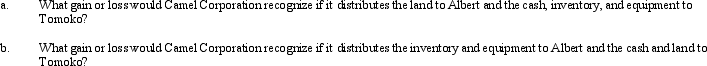

The stock in Camel Corporation is owned by Albert and Tomoko, who are unrelated.Albert owns 30% and Tomoko owns 70% of the stock in Camel Corporation. All of Camel Corporation's assets were acquired by purchase.The following assets are to be distributed in complete liquidation of Camel Corporation:

Correct Answer:

Verified

Q32: The stock in Toucan Corporation is held

Q36: The determination of whether a shareholder's gain

Q38: Corporate reorganizations can meet the requirements to

Q39: On April 7, 2011, Crow Corporation acquired

Q40: For a corporate restructuring to qualify as

Q42: Which of the following statements is correct

Q44: The stock of Cardinal Corporation is held

Q45: All of the following statements are true

Q45: After a plan of complete liquidation has

Q46: Mary and Jane, unrelated taxpayers, own Gray

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents