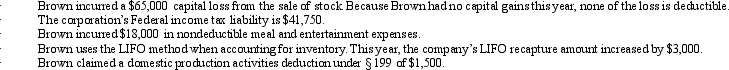

Brown Corporation, an accrual basis corporation, has taxable income of $150,000 in the current year.Included in its determination of taxable income are the following transactions.

What is Brown's current E & P for the year?

What is Brown's current E & P for the year?

Correct Answer:

Verified

Q132: The gross estate of Raul, decedent who

Q133: Daisy Corporation is the sole shareholder of

Q145: Scarlet Corporation is an accrual basis, calendar

Q147: Stephanie is the sole shareholder and president

Q152: Ashley, the sole shareholder of Hawk Corporation,

Q154: Sylvia owns 25% of Cormorant Corporation. Cormorant

Q165: Gold Corporation has accumulated E & P

Q170: Briefly describe the reason a corporation might

Q173: Timothy owns 100% of Forsythia Corporation's stock.

Q183: When is a redemption to pay death

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents