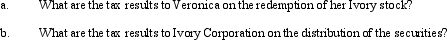

Ivory Corporation (E & P of $650,000) has 1,000 shares of common stock outstanding owned by unrelated parties as follows: Veronica, 500 shares, and Tommie, 500 shares. Veronica and Tommie each paid $125 per share for the Ivory stock 12 years ago.In May of the current year, Ivory distributes securities held as an investment (basis of $140,000, fair market value of $250,000) to Veronica in redemption of 200 of her shares.

Correct Answer:

Verified

Q126: Steve has a capital loss carryover in

Q129: Tanya is in the 35% tax bracket.

Q132: The gross estate of Raul, decedent who

Q133: Daisy Corporation is the sole shareholder of

Q145: Scarlet Corporation is an accrual basis, calendar

Q152: Ashley, the sole shareholder of Hawk Corporation,

Q155: Finch Corporation (E & P of $400,000)

Q169: How does the definition of accumulated E

Q170: Briefly describe the reason a corporation might

Q178: How does the payment of a property

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents