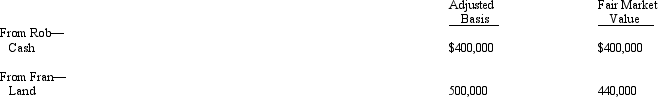

Rob and Fran form Bluebird Corporation with the following investments.  Each receives 50% of Bluebird's stock.In addition, Fran receives cash of $40,000.One result of these transfers is that Fran has a:

Each receives 50% of Bluebird's stock.In addition, Fran receives cash of $40,000.One result of these transfers is that Fran has a:

A) Recognized loss of $60,000.

B) Recognized loss of $20,000.

C) Basis of $460,000 in the Bluebird stock (assuming Bluebird reduces its basis in the land to $440,000) .

D) Basis of $400,000 in the Bluebird stock (assuming Bluebird reduces its basis in the land to $440,000) .

E) None of the above.

Correct Answer:

Verified

Q52: Lucy and Marta form Blue Corporation. Lucy

Q53: Three individuals form Skylark Corporation with the

Q55: Kevin and Nicole form Indigo Corporation with

Q56: Amy owns 20% of the stock of

Q58: Dick, a cash basis taxpayer, incorporates his

Q60: Lucy transfers equipment (basis of $25,000 and

Q62: Nancy, Guy, and Rod form Goldfinch Corporation

Q67: Wade and Paul form Swan Corporation with

Q73: Sarah and Tony (mother and son) form

Q87: When Pheasant Corporation was formed under §

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents