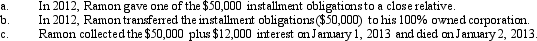

Ramon sold land in 2012 with a cost of $80,000 for $200,000.The sales agreement called for a $50,000 down payment and a $50,000 payment plus 8% interest to be received on the first day of each year for the next three years.What would be the consequences of the following (treat each part independently and assume Ramon uses the installment method whenever possible):

Correct Answer:

Verified

Q62: Kathy was a shareholder in Matrix, Inc.,

Q63: Dr.Stone incorporated her medical practice and elected

Q64: Camelia Company is a large commercial real

Q65: Gold Corporation sold its 40% of the

Q66: Walter sold land (a capital asset) to

Q68: Charlotte sold her unincorporated business for $600,000

Q69: Robin Construction Company began a long-term contract

Q70: Related-party installment sales include all of the

Q71: Which of the following is (are) a

Q72: Pedro, not a dealer, sold real property

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents