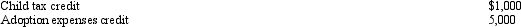

Prior to the effect of the tax credits, Justin's regular income tax liability is $200,000 and his tentative AMT is $195,000.Justin has the following credits:  Calculate Justin's tax liability after credits.

Calculate Justin's tax liability after credits.

A) $190,000.

B) $194,000.

C) $195,000.

D) $200,000.

E) None of the above.

Correct Answer:

Verified

Q38: The recognized gain for regular income tax

Q39: Kerri, who had AGI of $120,000, itemized

Q40: Nell has a personal casualty loss deduction

Q41: C corporations are subject to a positive

Q42: The AMT exemption for a C corporation

Q44: Vicki owns and operates a news agency

Q45: If the taxpayer elects to capitalize intangible

Q46: The C corporation AMT rate can be

Q48: Jackson sells qualifying small business stock for

Q54: Certain adjustments apply in calculating the corporate

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents