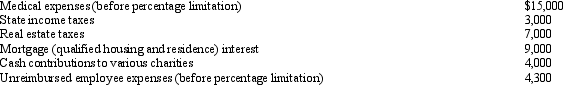

Mitch, who is single and has no dependents, had AGI of $100,000 in 2012.His potential itemized deductions were as follows:  What is the amount of Mitch's AMT adjustment for itemized deductions for 2012?

What is the amount of Mitch's AMT adjustment for itemized deductions for 2012?

A) $14,800.

B) $16,800.

C) $19,300.

D) $25,800.

E) None of the above.

Correct Answer:

Verified

Q56: Meg, who is single and age 36,

Q57: Miriam, who is a head of household

Q58: Which of the following statements is correct?

A)The

Q59: The AMT does not apply to qualifying

Q60: Kay had percentage depletion of $119,000 for

Q62: Omar acquires used 7-year personal property for

Q63: Which of the following can produce an

Q64: On January 3, 1998, Parrot Corporation acquired

Q65: Eula owns a mineral property that had

Q66: In 2012, Sean incurs $90,000 of mining

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents