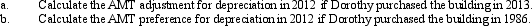

In September, Dorothy purchases a building for $900,000 to use in her business as a warehouse.Dorothy uses the depreciation method which will provide her with the greatest deduction for regular income tax purposes.

Correct Answer:

Verified

Q87: In calculating her taxable income, Rhonda deducts

Q88: Sand Corporation, a calendar year taxpayer, has

Q89: Frederick sells land and building whose adjusted

Q90: Use the following data to calculate Diane's

Q91: Tad and Audria, who are married filing

Q93: Bianca and Barney have the following for

Q95: In May 2011, Egret, Inc.issues options to

Q96: Smoke, Inc., provides you with the following

Q97: Sage, Inc., has the following gross receipts

Q104: Why is there a need for a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents