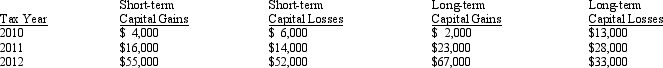

The chart below details Sheen's 2010, 2011, and 2012 stock transactions.What is the capital loss carryover to 2012 and what is the net capital gain or loss for 2012?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q74: Hilda lent $2,000 to a close personal

Q114: Lynne owns depreciable residential rental real estate

Q115: Assume a building is subject to §

Q116: Theresa and Oliver, married filing jointly, and

Q117: A retail building used in the business

Q118: On January 10, 2012, Wally sold an

Q120: An individual has a $20,000 § 1245

Q121: Harold is a head of household, has

Q123: In early 2011, Wendy paid $66,000 for

Q124: A business machine purchased April 10, 2010,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents