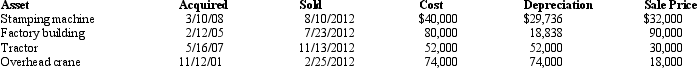

The chart below describes the § 1231 assets sold by the Ecru Company (a sole proprietorship) this year.Compute the gain or loss from each asset disposition and determine the net § 1231 gain treated as long-term capital gain for the year.Assume there is a § 1231 lookback loss of $4,000.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q70: Ranja acquires $200,000 face value corporate bonds

Q74: Hilda lent $2,000 to a close personal

Q123: In early 2011, Wendy paid $66,000 for

Q124: A business machine purchased April 10, 2010,

Q125: Mike is a self-employed TV technician.He is

Q126: Betty, a single taxpayer with no dependents,

Q129: A business machine purchased April 10, 2011,

Q130: Jamison owned a rental building (but not

Q131: A business taxpayer sold all the depreciable

Q132: What characteristics must the seller of a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents