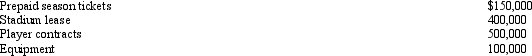

Marge purchases the Kentwood Krackers, a AAA level baseball team, for $1.5 million.The appraised values of the identified assets are as follows:

The Krackers have won the pennant for the past two years.Determine Marge's adjusted basis for the assets of the Kentwood Krackers.

The Krackers have won the pennant for the past two years.Determine Marge's adjusted basis for the assets of the Kentwood Krackers.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: Hubert purchases Fran's jewelry store for $950,000.The

Q3: Ed and Cheryl have been married for

Q4: Robert sold his ranch which was his

Q8: On January 15 of the current taxable

Q10: Hilary receives $10,000 for a 13-foot wide

Q11: Annette purchased stock on March 1, 2012,

Q12: Faith inherits an undivided interest in a

Q88: Nigel purchased a blending machine for $125,000

Q101: Peggy uses a delivery van in her

Q207: Monica sells a parcel of land to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents