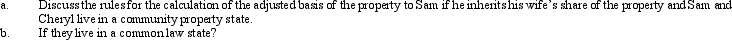

Sam and Cheryl, husband and wife, own property jointly.The property has an adjusted basis of $400,000 and a fair market value of $500,000.

Correct Answer:

Verified

Q40: Sammy exchanges equipment used in his business

Q42: Describe the relationship between the recovery of

Q46: Lois received nontaxable stock rights with a

Q48: Taylor owns common stock in Taupe, Inc.,

Q204: If a taxpayer purchases a business and

Q222: Discuss the application of holding period rules

Q241: What effect does a deductible casualty loss

Q246: How is the donee's basis calculated for

Q252: Define a bargain purchase of property and

Q254: Define fair market value as it relates

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents