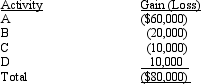

Hugh has four passive activities which generate the following income and losses in the current year.

How much of the $80,000 net passive loss can Hugh deduct this year? Calculate the suspended losses (by activity).

How much of the $80,000 net passive loss can Hugh deduct this year? Calculate the suspended losses (by activity).

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q78: Skeeter invests in vacant land for the

Q79: Kenton has investments in two passive activities.Activity

Q80: Wes's at-risk amount in a passive activity

Q81: Joyce, an attorney, earns $100,000 from her

Q82: In 2012, Emily invests $100,000 in a

Q84: Identify how the passive loss rules broadly

Q85: Sam, who earns a salary of $400,000,

Q111: Pat sells a passive activity for $100,000

Q114: Vail owns interests in a beauty salon,

Q115: Anne sells a rental house for $100,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents