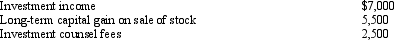

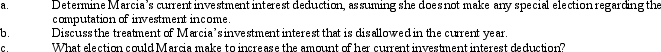

Marcia borrowed $110,000 to acquire a parcel of land to be held for investment purposes and paid interest of $9,000 on the loan. Other items related to Marcia's investments include the following:

Marcia is unmarried, has AGI of $65,000, and elects to itemize her deductions.She has no miscellaneous itemized deductions other than the investment counsel fees.

Marcia is unmarried, has AGI of $65,000, and elects to itemize her deductions.She has no miscellaneous itemized deductions other than the investment counsel fees.

Correct Answer:

Verified

Q84: Identify how the passive loss rules broadly

Q85: Sam, who earns a salary of $400,000,

Q90: Ken has a $40,000 loss from an

Q91: In the current year, Lucile, who has

Q93: What special passive loss treatment is available

Q111: Pat sells a passive activity for $100,000

Q114: Vail owns interests in a beauty salon,

Q115: Anne sells a rental house for $100,000

Q122: Last year, Wanda gave her daughter a

Q125: Discuss the treatment given to suspended passive

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents