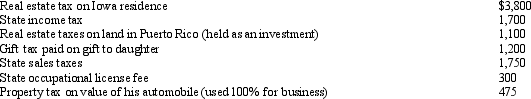

During 2012, Hugh, a self-employed individual, paid the following amounts:  What is the maximum amount Hugh can claim as taxes in itemizing deductions from AGI?

What is the maximum amount Hugh can claim as taxes in itemizing deductions from AGI?

A) $6,600.

B) $6,650.

C) $7,850.

D) $8,625.

E) None of the above.

Correct Answer:

Verified

Q61: Emily, who lives in Indiana, volunteered to

Q75: Your friend Scotty informs you that he

Q76: Zeke made the following donations to qualified

Q77: Ron and Tom are equal owners in

Q78: Tom is advised by his family physician

Q80: Phillip developed hip problems and was unable

Q82: Helen pays nursing home expenses of $3,000

Q82: Charles, who is single, had AGI of

Q83: Samuel, an individual who has been physically

Q84: During 2012, Ralph made the following contributions

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents