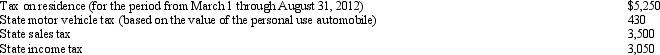

During 2012, Nancy paid the following taxes:  Nancy sold her personal residence on June 30, 2012, under an agreement in which the real estate taxes were not prorated between the buyer and the seller.What amount qualifies as a deduction from AGI for 2012 for Nancy?

Nancy sold her personal residence on June 30, 2012, under an agreement in which the real estate taxes were not prorated between the buyer and the seller.What amount qualifies as a deduction from AGI for 2012 for Nancy?

A) $9,180.

B) $9,130.

C) $7,382.

D) $5,382.

E) None of the above.

Correct Answer:

Verified

Q61: Emily, who lives in Indiana, volunteered to

Q68: In 2012, Roseann makes the following donations

Q69: Diego, who is single and lives alone,

Q70: Brad, who uses the cash method of

Q71: In 2012, Jerry pays $8,000 to become

Q72: Rosie owned stock in Acme Corporation that

Q75: Your friend Scotty informs you that he

Q76: Zeke made the following donations to qualified

Q77: Ron and Tom are equal owners in

Q78: Tom is advised by his family physician

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents