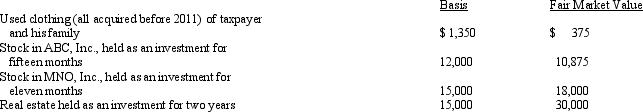

Zeke made the following donations to qualified charitable organizations during 2012:  The used clothing was donated to the Salvation Army; the other items of property were donated to Eastern State University. Both are qualified charitable organizations. Disregarding percentage limitations, Zeke's charitable contribution deduction for 2012 is:

The used clothing was donated to the Salvation Army; the other items of property were donated to Eastern State University. Both are qualified charitable organizations. Disregarding percentage limitations, Zeke's charitable contribution deduction for 2012 is:

A) $43,350.

B) $56,250.

C) $59,250.

D) $60,375.

E) None of the above.

Correct Answer:

Verified

Q61: Emily, who lives in Indiana, volunteered to

Q71: In 2012, Jerry pays $8,000 to become

Q72: Rosie owned stock in Acme Corporation that

Q73: During 2012, Nancy paid the following taxes:

Q75: Your friend Scotty informs you that he

Q77: Ron and Tom are equal owners in

Q78: Tom is advised by his family physician

Q79: During 2012, Hugh, a self-employed individual, paid

Q80: Phillip developed hip problems and was unable

Q82: Helen pays nursing home expenses of $3,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents