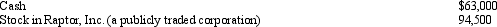

During 2012, Ralph made the following contributions to the University of Oregon (a qualified charitable organization) :  Ralph acquired the stock in Raptor, Inc., as an investment fourteen months ago at a cost of $42,000. Ralph's AGI for 2012 is $189,000. What is Ralph's charitable contribution deduction for 2012?

Ralph acquired the stock in Raptor, Inc., as an investment fourteen months ago at a cost of $42,000. Ralph's AGI for 2012 is $189,000. What is Ralph's charitable contribution deduction for 2012?

A) $56,700.

B) $63,000.

C) $94,500.

D) $157,500.

E) None of the above.

Correct Answer:

Verified

Q79: During 2012, Hugh, a self-employed individual, paid

Q80: Phillip developed hip problems and was unable

Q82: Charles, who is single, had AGI of

Q82: Helen pays nursing home expenses of $3,000

Q83: Samuel, an individual who has been physically

Q85: Marilyn is employed as an architect.For calendar

Q86: Paul, a calendar year married taxpayer, files

Q87: During the current year, Maria and her

Q88: Brian, a self-employed individual, pays state income

Q89: George is single, has AGI of $255,300,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents