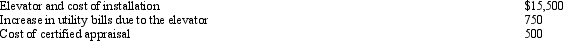

Timothy suffers from heart problems and, upon the recommendation of a physician, has an elevator installed in his personal residence. In connection with the elevator, Timothy incurs and pays the following amounts during the current year:

The system has an estimated useful life of 20 years. The appraisal was to determine the value of Timothy's residence with and without the system. The appraisal states that the system increased the value of Timothy's residence by $2,000. How much of these expenses qualify for the medical expense deduction (before application of the 7.5% limitation) in the current year?

The system has an estimated useful life of 20 years. The appraisal was to determine the value of Timothy's residence with and without the system. The appraisal states that the system increased the value of Timothy's residence by $2,000. How much of these expenses qualify for the medical expense deduction (before application of the 7.5% limitation) in the current year?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q81: Harry and Sally were divorced three years

Q93: Linda, who has AGI of $120,000 in

Q94: During 2012, Kathy, who is self-employed, paid

Q95: Virginia had AGI of $100,000 in 2012.

Q96: In 2005, Ross, who is single, purchased

Q97: Pat died this year.Before she died, Pat

Q99: For calendar year 2012, Jon and Betty

Q100: Donald owns a principal residence in Chicago,

Q101: Linda borrowed $60,000 from her parents for

Q103: Antonio sold his personal residence to Mina

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents